As international developers of renewable energy projects, the query "does renewable energy save money" is one we analyze daily. The question is not academic; it is the central financial driver of the global energy transition.

The direct and definitive answer is yes.

From a technical and financial standpoint, renewable energy saves money by fundamentally changing the cost structure of power generation. It moves the entire model away from purchasing finite "stock" (fuel) and toward harnessing a free "flow" (natural energy).

The confusion for many arises from the difference between the upfront price and the lifetime cost. A conventional power plant has a lower upfront price but is tied to a lifetime of volatile fuel expenses. A renewable plant has a high upfront price but a lifetime of zero fuel expenses.

Understanding the Two Key Cost Metrics: CapEx vs. LCOE

To analyze this properly, we must use the two key financial metrics that govern all utility-scale projects: CapEx and LCOE.

1. Capital Expenditure (CapEx)

This is the upfront cost to build and install the energy-generating asset. For fossil fuels, this is the cost of the turbine and power plant. For renewables, this is the cost of the solar panels, wind turbines, or battery storage systems. Historically, the high CapEx of renewables has been the primary barrier to adoption.

2. Levelized Cost of Energy (LCOE)

This is the true lifetime cost of electricity. LCOE is the metric we use to make direct, apples-to-apples comparisons between different power sources.

The calculation is simple: LCOE = (Total Lifetime Cost to Build & Operate) / (Total Lifetime Energy Produced)

A low LCOE means the electricity is cheap. A high LCOE means it is expensive. Because renewable projects have zero fuel cost, their LCOE has plummeted as their CapEx (technology cost) has fallen, making them the cheapest form of new energy in history.

How Renewable Energy Saves Money: A Technical Comparison

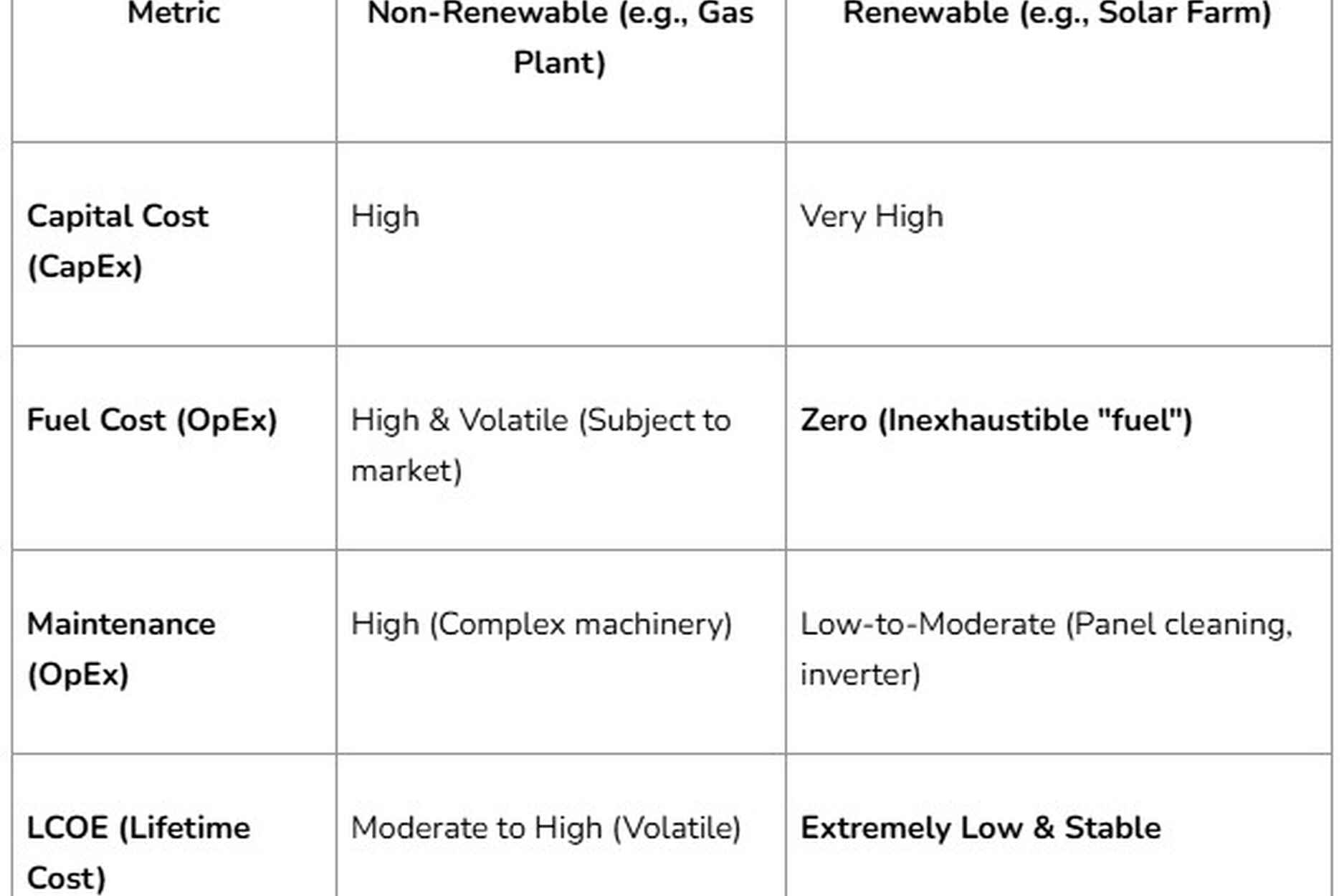

he most straightforward way to understand the potential savings is by directly comparing the cost components of a new solar farm — which we develop — with those of a newly constructed natural gas power plant. This comparison highlights the differences in capital investment, operational expenses, fuel costs, and long-term maintenance, illustrating how solar energy can offer significant financial advantages over time, particularly due to its low operating costs and zero fuel requirements.

This table clearly illustrates the financial trade-off between renewable and conventional energy sources. While renewable energy projects, such as solar or wind farms, demand a higher upfront capital investment, they offer a distinct long-term advantage: once installed, the cost of generating electricity remains stable and predictable for the next 20 to 30 years. In other words, renewables effectively “lock in” a fixed, low price for electricity, insulating consumers and investors from the volatility of fossil fuel prices and reducing long-term financial risk.

Savings at the Utility & Grid Scale

At the grid scale, where we operate, the financial benefits are profound.

Grid Parity: In most of the world, the LCOE of new utility-scale solar and wind is now lower than the LCOE of new fossil fuel plants. This milestone is known as "grid parity." It is now, in most cases, cheaper to build new solar than to build new coal or gas.

Insulation from Price Volatility: A renewable power plant is a fixed asset, not a commodity-driven one. It is completely insulated from geopolitical events, supply chain disruptions, and market speculation that cause oil and natural gas prices to spike. This provides immense financial stability and predictability for national economies.

Savings at the Consumer & Business Scale

At the consumer or business level (such as on-site generation for industry or agrivoltaics for farms), the principle is the same but the timeline is compressed.

High Upfront Cost (CapEx): The individual must purchase the system (e.g., rooftop solar).

The Payback Period: This is the time it takes for the monthly savings on the electricity bill to equal the initial CapEx. This can range from 5 to 12 years.

Long-Term Savings: After the payback period is met, the electricity generated by the system is effectively free for the remainder of its 25+ year lifespan, representing pure savings.

Our Expert Conclusion

To answer the query directly: Renewable energy saves money by eliminating the single greatest and most volatile cost in energy generation: the fuel.

This transition requires viewing energy not as a monthly expense (a fuel bill) but as a long-term investment (a fixed asset). Whether at the utility scale or the consumer scale, the financial model is the same: a higher upfront capital cost is traded for decades of stable, predictable, and exceptionally low-cost energy.

Resources

Lazard's Levelized Cost of Energy Analysis (LCOE):

https://www.lazard.com/research-insights/levelized-cost-of-energy-levelized-cost-of-storage-and-levelized-cost-of-hydrogen-v170

International Energy Agency (IEA) - Renewables: https://www.iea.org/energy-topics/renewables

U.S. National Renewable Energy Laboratory (NREL): https://www.nrel.gov